california lottery tax rate|federal tax on lottery winnings 2019 : Bacolod State: California (No State Income Tax on Lottery Winnings) Federal Withholding: $10,000,000 * 0.24 = $2,400,000; Actual Winning Before Tax: $10,000,000 .

The Professional Regulation Commission (PRC) releases the room assignments for the April 2024 Physician Licensure Exam (PLE) a few weeks before the examination. This year’s 1st Physician Licensure Exam (PLE) will be conducted on April 7-8 & 14-15, 2024. Room Assignments. Below are room assignments for the April 2024 .

california lottery tax rate,The state tax on lottery winnings is 0% in California, which you'll have to pay on top of the federal tax of 25%. There might be additional taxes to pay, the exact amount of these depends on the size of the jackpot, the city you live in, the state you bought the ticket in, . California does not tax lottery winnings, but the IRS does withhold 25 percent for federal taxes. Learn how to report and pay taxes . The Internal Revenue Service (IRS) imposes a federal tax rate of 24%, and California’s state income tax, with rates ranging from 1% to 13.3%, adds an additional .Lottery winnings are considered taxable income for both federal and state taxes. Federal tax rates vary based on your tax bracket, with rates up to 37%. Winning the lottery can bump you into a higher tax bracket. Lottery . California Lottery Taxes. Golden State residents do not have to pay state taxes on California State Lottery winnings, but federal taxes are owed. Those .federal tax on lottery winnings 2019 State: California (No State Income Tax on Lottery Winnings) Federal Withholding: $10,000,000 * 0.24 = $2,400,000; Actual Winning Before Tax: $10,000,000 .

Information. Tax Calculator. Powerball prizes are subject to tax so it is not just a case of looking at the advertised amounts to see how much money you would receive if .

How much will the jackpot be taxed in California? You get two choices when you win the jackpot — get paid annually over time or get a one-time cash payout. It’s . The lottery tax calculator (or taxes on lottery winnings calculator) helps you estimate the tax amount deducted from a lottery prize and compare the money you . Lottery winnings, considered taxable income, are subject to both federal and state income taxes. The Internal Revenue Service (IRS) imposes a federal tax rate of 24%, and California’s state income tax, with rates ranging from 1% to 13.3%, adds an additional layer of taxation.That in turn would increase the percentage of state tax you have to pay not just on your gambling winnings, but on your entire personal income. California sets several income thresholds, and where you land determines your state tax obligation. Currently, the lowest state tax rate is 1%, while the highest is 12.3%.

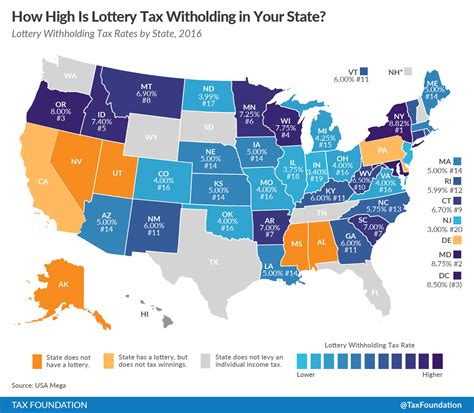

Threshold for State Tax; No state tax on lottery prizes: California, Florida, New Hampshire, Puerto Rico, South Dakota, Tennessee, Texas, U.S Virgin Islands, Washington State, Wyoming: N/A: 2.9%: North Dakota: $5,000: . applies a local tax of 3.876 percent in addition to the top state income tax rate of 10.9 percent and the top federal rate .

If you have a different tax filing status, check out our full list of tax brackets. $0 to $11,600. 10% of taxable income. $11,601 to $47,150. $1,160 plus 12% of the amount over $11,600. $47,151 to .

The federal tax on the lottery is determined by the federal marginal rates, which is 37 percent in the highest bracket. In practice, there is a 24 percent federal withholding of the gross prize, plus the remaining tax, based on your filing status.. For example, if your gross prize is $1,000,000, you need to pay $334,072 in total taxes .

Here are some key federal income tax considerations for lottery winners: Tax Rates: Federal tax rates are progressive, meaning that higher income levels are subject to higher tax rates. Lottery winnings, which can be substantial, may push you into a higher tax bracket. . California’s taxation of lottery winnings is just one part of the .

The California Lottery is required by the Internal Revenue Service to withhold federal taxes on many prizes. There is no California state or local tax withholding. The rate on federal withholding . What is the Tax Rate for Lottery Winnings? To give you a general overview, let’s use the United States as an example, if you win the lottery, the federal and state governments will typically take a percentage of your winnings. You may also pay local taxes. The exact percentage can vary, but it usually ranges from 25% to 37%. From June 2020 to June 2021, the California state lottery dispensed $5.6 billion in winnings. Even if California taxed those winnings at the median income tax rate of 6%, that would net the state .The withholding rate for federal income tax is based, in part, on a claimant’s resident status. The Lottery is required to withhold federal taxes of . California Lottery by December 31 for the tax year in which the prize was paid. Using the information provided on the IRS Form 5754, the California Lottery will issue an IRS W2-G The table below shows the payout schedule for a jackpot of $20,000,000 for a ticket purchased in California, including taxes withheld. Please note, the amounts shown are very close approximations to the amount a jackpot annuity winner would receive from the lottery every year. . 37% marginal rate: State Tax: No state tax on lottery prizes .california lottery tax rate No California Tax on Winnings. The California Lottery will still withhold 24 percent of your winnings to pay federal taxes if you’re a U.S. citizen or resident alien, and 30 percent if you’re not. The California lottery taxes Scratcher winnings the same way if they're $600 or more. The store where you bought the Scratcher is not required to .The withholding rate for federal income tax is based, in part, on a claimant’s resident status. The Lottery is required to withhold federal taxes of . California Lottery by December 31 for the tax year in which the prize was paid. Using the information provided on the IRS Form 5754, the California Lottery will issue an IRS W2-Gcalifornia lottery tax rate federal tax on lottery winnings 2019 California Department of Tax and Fee Administration Cities, Counties, and Tax Rates. . The undersigned certify that, as of June 13, 2023, the internet website of the California Department of Tax and Fee Administration is designed, developed, and maintained to be in compliance with California Government Code Sections 7405, 11135, .

The withholding rate for federal income tax is based, in part, on a claimant’s resident status. The Lottery is required to withhold federal taxes of . California Lottery by December 31 for the tax year in which the prize was paid. Using the information provided on the IRS Form 5754, the California Lottery will issue an IRS W2-G While there is presently no estate tax here in California, there is a federal estate tax. The present federal estate tax exemption in 2023 is $12.92 million. The federal estate tax rate ranges between 18% to 40%, so this can be a significant factor in your planning. In summary, the best tax tips for lottery winners include: The Mega Millions annuity jackpot is awarded according to an annually-increasing rate schedule, which increases the amount of the annuity payment every year. The table below shows the payout schedule for a jackpot of $137,000,000 for a ticket purchased in California, including taxes withheld. Please note, the amounts shown are .The chart below breaks down the California tax brackets using this model: Single Tax Brackets. Married Filing Jointly Tax Brackets. For earnings between $0.00 and $10,099.00, you'll pay 1%. For earnings between $10,099.00 and $23,942.00, you'll pay 2% plus $100.99. For earnings between $23,942.00 and $37,788.00, you'll pay 4% plus $377.85.

california lottery tax rate|federal tax on lottery winnings 2019

PH0 · lottery taxes by state calculator

PH1 · lottery tax rates by state

PH2 · federal tax on lottery winnings 2019

PH3 · does california tax powerball winnings

PH4 · california tax lottery winnings

PH5 · ca lottery taxes calculator

PH6 · Iba pa